Blue ocean strategy generally refers to the creation by a company of a new, uncontested market space that makes competitors irrelevant and that creates new consumer value often while decreasing costs.

Blue Ocean Strategy assists us during strategic planning. It enables us to concentrate on the creation of new markets via new offerings, with the aim being to make the competition irrelevant so that an organization can grow. Blue Oceans can be thought of as markets that do not exist yet. The microwave oven would have been a blue ocean in the 1970s. Conversely, Red Oceans can be thought of as all the marketplaces which currently exist.

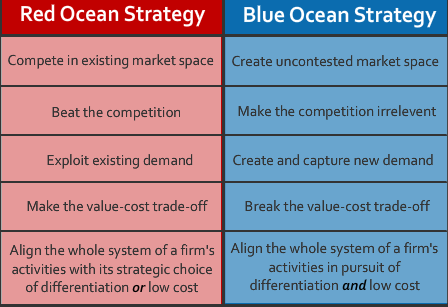

As such, Red Oceans already contain a number of competitors. A Red Ocean Strategy is a strategy which is aims to fight and beat the competition. Red Ocean Strategies have the following common characteristics:

- They focus on competing in a marketplace which already exists.

- They focus on beating the competition.

- They focus on the value/cost trade-off. The value/cost trade-off is the view that a company has the choice between creating more value for customers but at a higher cost, or reasonable value for customers at a lower cost. In contrast, those who attempt a blue ocean strategy aim to achieve differentiation and at the same time, low cost.

- They focus on exploiting existing demand.

- They focus on execution (better marketing, lower cost base etc).

A Red Ocean Strategy ultimately leads to an organization choosing to follow one of two strategies – differentiation or low cost. Whichever is chosen the organization must align all activities with one of these strategic directions.

That is, evaluate which factors the industry takes for granted but which can eliminated, which factors can be reduced to below industry standards, which new factors should be created, and which should be raised above industry standards.

Consider how Ninentendo employed the blue ocean strategy with the Wii. Wii’s launch helped Nintendo grow sales 90 per cent and profits, 77 per cent. Its better established rival, Sony, was losing 240 on each Playstation 3 model sold, while Nintendo was making 40 on each Wii sold, Mauborgne said. With the Wii, what Ninentdo did was ask itself how many customers used high-definition TV compatibility, a feature that was pushing up the cost of the console.

The answer was hardly any. So it decided to do away with this feature, keep the price of the Wii low and also target non-core gamers with the product. Thus using a blue ocean strategy, it created a new market for itself instead of fighting for share in the market space dominated by Sony’s Playstation and Microsoft’s Xbox.

Blue ocean focuses on how to link innovation to commercial value. While traditional strategy, or red ocean strategy, exploits existing demand, blue ocean strategy creates and captures new demand in the same manner that Nintendo did with the launch of the Wii,.

What Nintendo did was create an uncontested market space and make the competition irrelevant. Also in a red ocean, competing companies usually have to choose between differentiating themselves at the expense of pushing up costs, or stay low cost and undifferentiated from rivals.

In a blue ocean, companies realise both differentiation and low cost. In other words, returns from investments in blue oceans are substantially higher. Yet 86 per cent of business launches by companies fall in the red ocean category. The revenue impact of these red ocean launches, according to studies by Mauborgne and her colleagues, was 62 per cent and profit impact 39 per cent.

The remaining 14 per cent of business launches that fell in the blue ocean category, accounted for 38 per cent of revenues and had a profit impact of 61 per cent. "As sensible leaders, we should be investing more in blue oceans. But they (companies) always sign cheques for red. We know innovation is important but we have not learnt how to control risk and do it in a systematic manner.

So is innovation a black box? . In the 1960s, quality was also not measurable. But in the late 70s and 80s, Japan came up with the concept of total quality management and just-in-time manufacturing.

![]()

Later the concept of six sigma was born and today, quality is measurable. Blue oceans are not about technology innovation. Research into blue ocean strategies in the 120-year-period from 1880-2000 demonstrates blue oceans are not about technology innovation.

For instance, although the hugely successful iPod uses sophisticated technology, people buy it because it is so stylish and simple. In the earlier example, Ninentendo, in fact, cut down on technology to achieve a blue ocean. “Incumbents often create blue oceans within their core businesses,” .

But there is no permanently excellent company or industry. “You’re only as good as your most recent strategic move”.

Take Sony, which launched the Walkman and created a market for a personal stereo, which was so far non-existent - again, a blue ocean. But since then Sony has done many right and wrong things.

However, the power of the blue ocean it created back then, still endures. And even today, Sony is top of mind recall for anyone who thinks of buying a music system or video recorder.

There many examples of blue ocean strategies across industries. In late 1990s, the retail financial industry was highly competitive. Traditional banks were offering more and more services with personalised offerings, and online companies were trying to imitate.

In this scenario, ING Direct, came up with a blue ocean, a value proposition, which was to offer fewer products and four times higher savings rate with no minimum or maximum deposit. It realised the vast number of products in the market were creating more confusion than choice to the customer.

Think about what ING Direct did in the late 1990s. Traditional banks have long operated in a red ocean of bloody competition. Virtually all strive to offer more and more personalized services to attract and retain premium customers, with dozens of financial products and hundreds of variants within each category. The underlying assumption here is that a key to success is to block out competitors by capturing a 100 percent share of customers’ total financial needs. The result is high cost structures with few people in traditional banks knowledgeable enough to cross-sell such an extensive array of products and services. ING Direct, however, challenged all of this. Instead of fighting to capture 100 percent of customers’ banking needs, ING Direct completely did away with offering current accounts. Current accounts often have low balances and extensive operational costs because of the number of transactions that run through them. Instead ING Direct drastically reduced the number of products and services to the bare minimum with a focus on savings and mortgage accounts. By simplifying the complexity of operations and lowering its own cost structure, ING Direct was able to offer savings rates up to four times higher than the industry average. This also made ING Direct’s website simple and easy to use and made financial decisions easier for people to make. At the same time, it enjoyed one of the lowest cost structures in the industry.

As financial planning continues to grow, it becomes more and more competitive, and increasingly difficult for firms to differentiate themselves. As a result, firms slow their growth rates, and some struggle to survive or grow at all. While most firms work harder and harder to make marginal improvements in their process, service, and value, to differentiate themselves from their competition, there is an alternative available: to seek to completely redefine the financial planning value proposition, letting go of things that are no longer truly important, and instead focusing on creating value that will make financial planning relevant to new audiences. And as financial planning enters the digital age, there is perhaps more opportunity than ever to begin doing things in a completely different - and better - way. So if you could rewrite the financial planning value proposition from scratch, would you still be doing it exactly the way that you do? Or is the reality that by letting go of “the way things have always been done” we could recreate a financial planning offering that would reach more people than ever?

The inspiration for today’s blog post is a book I read last year called Blue Ocean Strategy by W. Chan Kim and Renee Mauborgne. The basic principle of Blue Ocean Strategy is relatively straightforward - instead of competing in the bloody red oceans of the current marketplace where competition is fierce, strive to steer your business to a wide open blue ocean that has no competition. How do you get to a blue ocean of competition? Through value innovation - the simultaneous pursuit of differentiation and low cost.

So what does Blue Ocean Strategy look like in more practical terms? An example would be Cirque du Soleil, an organization that managed to successfully innovate and compete in what was previously the declining “circus” industry. How did Cirque du Soleil do it? By re-defining value in the circus - for instance, by targeting adults instead of children, and making it more like a theater experience, while retaining the lower cost aspects like basic, plain seats, and a show that has no big-name (and expensive) “star” draws. The end result is an experience that is not quite circus, nor theater… and that’s the point. Cirque du Soleil succeeded by not competing with the red oceans of circuses or theaters directly, but by creating its own new blue ocean.

Another example of Blue Ocean Strategy would be Southwest Airlines, which entered a brutally bloody red ocean existing airline industry that was struggling to even be economically viable. Southwest redefined their marketplace by eliminating what they viewed as unnecessary - from air route hubs to seating choices to lounges and meals - and focusing on what was appealing to attract people who were currently non-customers, such as by making departure times so frequent and flights so inexpensive that people who take short family trips by car would consider flying Southwest instead.

As the authors note, the key to finding a Blue Ocean is to look at the values delivered by traditional competitors, and the values that consumers want - including, and perhaps especially, those non-customers who currently do not even engage in the industry - and in the process, re-draw the value curve focusing on low cost where possible and high value differentiation where it matters. Below is an example of the value curve for Southwest compared to other airlines, and the alternative of traveling by car.

A similar example from the financial services industry might be the rise of Charles Schwab, who devastated the traditional brokerage model with a focus on low cost and differentiation. Schwab made their competition irrelevant by aggressively pursuing low cost - for instance, by eliminating expensive brokerage commissions, making their trading systems more efficient - while simultaneously differentiating themselves with online trading tools that opened up stock investing to a group of non-customers - the so-called “do it yourselfers” who previously did not engage the financial services industry at all. The end result was a company with explosive growth, not just because they took customers away from their competition (people who invested with brokers), but because they attracted customers who weren’t even prospects up until that point (do-it-yourselfers)!

So what does all of this mean for the financial planning world? We, too, have become an industry that is very set in its way of doing things. There is a “standard way” that financial planning is delivered, involving meetings with the planner, the production of the financial plan, and implementation and monitoring with standard financial services products. In other words, financial planners are increasingly competing against each other in an ever-bloodier red ocean, trying to differentiate with tiny changes at the margins while staying constrained by “the way things have always been done.”

In turn, this raises the question - what is it that we do in financial planning that we believe delivers value, but in reality just increases cost with limited benefit? For Southwest, the Blue Ocean meant letting go of traditional “requirements” in the airline industry that were actually high cost but limited consumer value, from serving meals on flights to offering lounges to providing predetermined seating assignments. In financial planning, what high cost items might we eliminate? The labor-intensive construction of the written financial plan? Regular in-person meetings that require a substantial time commitment of both planner and client? And what can we deliver that is genuinely valuable to an audience who previously has not engaged in financial planning at all?

As I’ve written previously, financial planning is just entering into the digital age, which will create a unique opportunity for financial planners to create a new value proposition to reach prospective clients and deliver value in ways never done before. The Blue Ocean Strategy authors suggest four key questions to ask for any industry to determine an ideal strategy for redefining value:

-

Which of the factors that the industry takes for granted should be eliminated?

-

Which factors should be reduced well below the industry’s standard?

-

Which factors should be raised well above the industry’s standard?

-

Which factors should be created that the industry has never offered?

So what do you think? How would you answer the questions above - what do you think could be eliminated, reduced, raised, and created? How would you draw the value canvas for financial planning as a business? What could we change to open up an entirely new marketplace for future financial planning consumers?