Is it possible or advisable to get a CPA if you work in a finance role? A confidant of mine encouraged me to check it out and grow my credentials. I’m not sure I qualifiy, I know I’d need some more accounting classes (that work would pay for) to qualify to sit for the exams. Is it worth it for someone who wishes to never do tax or audit, but looks at financial statements daily for their job?

Where you going to get the two years of audit and tax experience? Greenie grunted it out for that certificate!

^ Yeah that’s going to be the main thing in your way of getting the CPA. You can’t fake the experience, as it needs to be signed off by a CPA.

A bit of unsolicited advice.

If you are looking to get an accounting designation just because you look at FS daily then perhaps the opportunity cost for a CPA will be too high(considering the fact that you have to take 150 hours of accounting classes just to qualify for CPA.).

You can go for ACCA as an alternative to CPA.ACCA mostly covers everything that CPA teaches you.

ACCA is very flexible in terms of entry and work ex requirements.

Not a single person in the US has heard of ACCA.

I used to think, “Well, in order to be able to understand financial statements, one must be able to prepare them. In order to prepare them, one must be an accountant. And the only good accountants are CPA’s.”

I don’t think that anymore. In fact, if you’re not preparing or auditing financials, then a CPA is probably overkill.

I’d say it’s kinda like learning Arabic. It’s good knowledge, and it can’t hurt you. But the time and investment that it will take to do it is tremendous, and you’ll probably never get your money’s worth out of it.

As an aside, in Texas, you have to have experience under a CPA. So if your boss isn’t a CPA, you’ll never get the experience requirement, and never get the initials. Don’t know if the same is true in New York or not.

Remember too, that there’s probably a 150/30/24 requirement. That is, you need 150 hours of college, 30 in accounting, and 24 hours of upper-level business courses. The 150 and 24 is probably not a problem, but the 30 probably is. (Again check the NY state board of public accountancy for details.)

You must be foreign if you think Americans will respect foreign credentials as equivalent to local designations.

I really don’t think I need it, someone suggested I look at it. 99% sure I’ll pass, but I figured I’d tap the sole trifecta holder (MBA, CFA, CPA) on the forum for his .02.

I’ll also add I have no fuggin idea what is required to get the CPA other than a specified number of accounting credits.

+1

ACCA is mostly famous in Europe/ASIA/Middle east/Australia.

In NY, it looks like there are the standard three requirements - education, exam, and experience.

Education - need 150 hours, 33 in accounting, and 36 in “general business electives”. (In NY, the state will also deem you “educated” if you have 15 years of experience doing public accounting under a CPA’s supervision.)

Exam - Have to pass all four parts within a rolling 18 month period.

Experience - need one year of experience under a CPA.

To make a long story short—

It sounds like the CPA isn’t good deal for you. You’re already established, and don’t plan to enter the typical accounting profession (tax, audit, corporate accounting). Even if you don’t pay a dime, you’ll still spend a lot of time in class and after that, a lot of time studying for a test that will be marginal, at best.

That is, unless you’re getting that “wink-wink, nudge-nudge” from your CPA boss to do it. Then that might be a whole 'nother story.

Or if you want to make some easy cash on the side doing tax or books for small biz. That would be my motivation if I ever wanted to do it (CPA Canada that is).

Respect.

I’ll pass.

Personally, I think a better idea for a second job would be “financial advisor”. Even if you don’t know a lot of the details about retirement planning and estate planning and what not, you still know more than 90% of the people out there. The money’s probably better, and other than licensing and FINRA tests, there’s probably far less startup costs.

^ Fee only clients are hard to find and the commissioned life is not for me. Plus there is ongoing relationship management and the headache of clients whining about loses. Tax returns are one and done. Plug em and send em.

never heard of ACCA here either

I’ve heard of ACCA before becuase all the Indian guys talk about it on here

I’ve heard of ACCA before becuase all the Indian guys talk about it on here

I think there are no more than 50 -100 ACCA members in India.ACCA is not at all famous here.Indians are crazy about Indian CA only.ACCA is highly regarded in Europe/Singapore/Gulf nations.

http://www2.accaglobal.com/databases/pressandpolicy/global/3435730 http://ipassthecpaexam.com/acca-vs-cpa-us/

Source:http://ipassthecpaexam.com/acca-vs-cpa-us/ ACCA vs CPA (USA): Which is Better? Read My Analysis

April 28, 2013 By Stephanie Ng

If you are an accountant and are working towards a prestigious qualification, CPA (Certified Public Accountant) and ACCA (Association of Chartered Certified Accountants) may come to mind.

If you are an accountant and are working towards a prestigious qualification, CPA (Certified Public Accountant) and ACCA (Association of Chartered Certified Accountants) may come to mind.

ACCA vs CPA (USA): A Comparison

Should you go for ACCA vs CPA? Does it make sense to get both? Let’s take a look.

ACCA vs CPA: Organization Structure US CPA

The CPA license is granted by each of the 55 states or jurisdiction in the United States. There is no centralized body and each state has slightly different CPA exam and licensing requirements. International candidates are often confused and frustrated by the complicated application process.

ACCA

ACCA is based in the United Kingdom. It operates as a single entity with much simpler application process.

Although it is a statutory accounting body in the UK, international candidates generally consider the certification as a global brand.

ACCA vs CPA: Application & Qualification

This is probably the biggest difference when it comes to CPA vs ACCA.

US CPA

Candidates must have a minimum of a 4-year bachelor degree and preferably a master’s degree in order to fulfill the 150 credit hours, equivalent to 5 years in higher education.

Once you are approved for the exam, you will sit for the exam but you are on your own in terms of how to get prepared. Most candidates choose to take review courses to help in the studies.

ACCA

The entry level is much lower – you are qualified as long as you have 3 GCSEs and 2 A Levels in 5 separate subjects including Math and English. In other words, most high school graduates can qualify. If you have a bachelor degree in relevant subjects, you can apply for exemption on part or all of the papers at the Fundamental Level.

Unlike the US CPA, once candidates are registered, ACCA takes an active role in preparing you for the exam by providing study guides, paper exam papers. They also run a database of ACCA Approved Learning Partners.

ACCA vs CPA: Exam Content And Format US CPA

There are 4 parts of the exam: Financial Accounting & Reporting, Audit & Attestation, Regulation and Business Environment & Concepts.

The exam is 100% computerized consisting of multiple choice questions, task-based simulations (i.e. intense case studies) and written communications. Grading is mostly computerized.

You can choose to take the 4 parts one at a time, 2 at a time or even 4 at the same time. You can sit for the exam any time (Monday to Saturday) during the first 2 months of each quarter and at any prometric centers throughout the US as well as in Japan, Brazil and 4 Middle Eastern countries.

ACCA

There are 14 papers divided into Fundamental Level (9 papers) and Professional Level (5 papers). Candidates can apply to waive part or all of papers at the Fundamental Level.

Some but not all papers are computerized. The exam is offered in June and December each year in more than 170 countries throughout the world.

ACCA vs CPA: Time Required to Pass US CPA

Most candidates aim to pass the CPA exam within a year. Some who have the time and commitment can study all materials within 6 months, take all 4 parts of the exam in one go and pass.

ACCA

Given the number of papers and the fact the exams are held only twice a year, candidates generally need 3 to 4 years to complete all papers and become an ACCA member.

Reciprocity and Exemptions US CPA

AICPA (the US accounting body) has reciprocal agreement with 7 accounting bodies in the world. Their members can choose to take a simplified version of the exam known as IQEX. ACCA is not among these 7 accounting bodies.

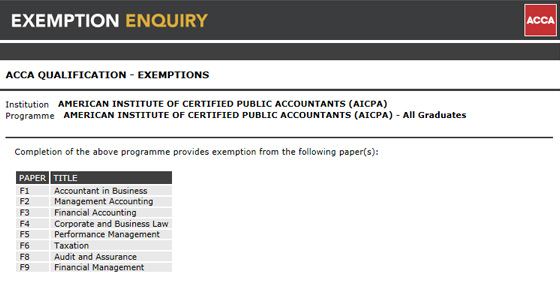

ACCA

ACCA is much more “generous” in this regard — exemptions are granted to AICPA members for 8 papers (see below) as well as Foundations of Accountancy. You can check out the exemptions from the link here.

Other Considerations

For the US CPA exam, unless you reside in the few countries where international exam sites are available (up to May 2012, these countries are Japan, Brazil, Bahrain, Kuwait, Lebanon, the UAE), you will have to travel to the US for the test.

On the other hand, the ACCA exam can be taken in more than 100 countries.

For candidates who come from a country that is exceedingly difficult to get a US VISA, ACCA could be a much preferred choice.

Conclusion

The US CPA is arguably the most prestigious accounting qualification. Entry barrier is high with an equivalent of a masters’ degree together with strict working experience requirements.

There are certain work that can only be done by CPA e.g. signing an audit report and opening a CPA firm. It has a distinct advantage to obtain this qualification especially if you can interested in public accounting in the United States or in American firms.

For ACCA, the application process is much simpler and entry barrier is low. However, it takes years to complete the studies and obtain the membership. While ACCA is globally recognized it is not the statutory accounting body, and not as highly regarded outside the UK and commonwealth countries.

If I Must Pick… Which One Should I Go For?

Since it is not possible to take advantage of the ACCA membership to get exemptions from the US CPA exam, it is wise to target either and not both.

As for ACCA vs CPA, it is like a question on Pepsi vs Coca Cola… it really depends on where you plan to work ![]()

Can I Be More Helpful?

If you are planning to pursue the CPA and would like to learn how to plan, study and pass the exam on your first attempt, check out this e-course which is absolutely free. You can also read more about this CPA exam mini-course before signing up.

I think the above mentioned blog beautifully explains the difference between ACCA and CPA.