Tough life nowadays. They didn’t even consider clubbing and Vegas trips with their rich f-boy friends.

Tough life nowadays. They didn’t even consider clubbing and Vegas trips with their rich f-boy friends.

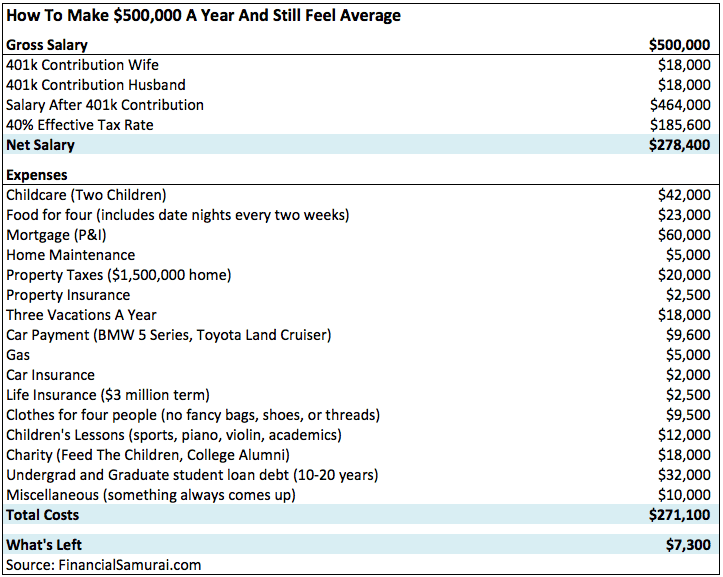

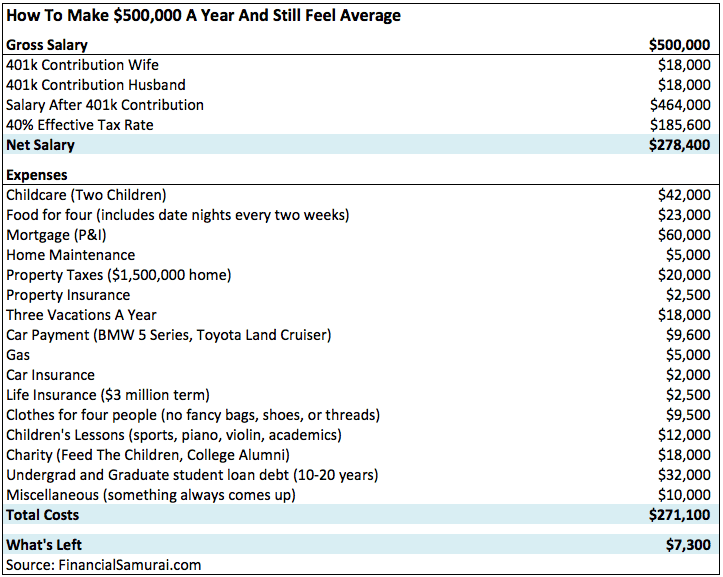

I heard about this. Seeing it now it’s not as obnoxious as it’s been portrayed.

18k for vacations is reasonable but definately not “normal”

32k for student debt is out of control. that should have been paid before they bought a 1.5 mil house (certainly before a BMW and Land Cruiser – total waste)

12k for childrens lessons is excessive especially if they’re still paying 42k in childcare which implies the children are young.

Idiots.

tax is the biggest expense. investing is key to tax avoidance!

I don’t think that’s bad. They’re not living “frugally”, but they are at least maxing out their 401k’s and have life insurance and $32k is for student debt.

Beyond that:

$10k is a reasonable miscellaneous (read as maintenance) bucket

$12k is for kids lessons

$18k is for charity

$62k Subtotal

These are reasonable expenses. Again, not frugal, but reasonable for someone that values extra curricular kid development, the $10k is sort of non-discretionary and the $18k charity is commendable. There’s definitely room to cut there and they are probably aware of it, but I don’t think this is a careless lifestyle.

Then there’s the $18k for vacations. Somewhat luxurious but probably worth it in a lot of ways for enjoying your current life. Hard to judge this without knowing their balance sheet, tbh. Regardless, they can instantly cut vacation and charity and have $36k in remainder. I don’t necessarily live this way, but don’t think it’s beyond the pale for someone with a different marginal utility equation.

They also did not seem to add back the tax deduction from mortgage, SALT, and charitable contributions. Also, I doubt that most households who make “only” $500k pay almost $20k to charity every year.

Student loan assumption is a bit unrealistic for most people. Most people who end up making $500k in the household come from upper middle class families to begin with - i.e. people who send kids to good colleges. Many of these people don’t have that much student debt, if any; parents paid for this in most people I know.

Adding back all this, and assuming no student debt and negligible charitable contributions, these guys should be saving an additional $60k per year. With the 401k contributions, they are saving $100k a year. I think this is more representative of the financial state for most people in this income range.

Yeah, I agree. I didn’t read the background and realize this was a standard estimate. I think they took averages for the population and applied them to this, but in reality like you pointed out taht’s not indicative of this strata of the population. I think the average for charity is heavily skewed to the extreme wealth group and the average for student loan balances is skewed to the lower wealth group so it’s fair to remove those two.

im shocked! everyone is definitely generous. the standard is 10% to charity according to rockefeller! in fact they are definitely undergifting! esp with the new tax law. best way to maximized itemized deductions is to double gift for a single year.

also making it rain in the club and helping single moms pursue a degree is definitely charity right? or at least biz expense

https://youtu.be/fls8VU7XClU?t=24

Got a handful of stacks, better grab an umbrella I make it rain, I make it rain (oh!) make it rain on them hoes

lol but in all seriousness have you guys done your taxes. trump really did sort of simplify the tax returns. lower tax rates with less bs deductions! that state tax thing imo is kind of shady, but with lower overall federal tax rates, ish all gravy

https://taxfoundation.org/90-percent-taxpayers-projected-tcja-expanded-standard-deduction/

The Tax Cuts and Jobs Act increased the standard deduction from $6,500 to $12,000 for single filers and $13,000 to $24,000 for taxpayers who are married filing jointly. Thus, millions of households will no longer need to go through the complex process of itemizing their deductions. The Joint Committee on Taxation estimates that the number of filers who itemize will fall from 46.5 million in 2017 to just over 18 million in 2018, meaning that about 88 percent of the 150 million households that file taxes will take the increased standard deduction.

My wife and I make around $220K per year. It’s been a good run since 4 years ago we barely broke $100K.

$36K to 401K

$40K to fed, state, local, FICA, etc taxes

$15K student loans

$10K for groceries for 4

$18K all in for the house, PITI

$6K vacations. Not a true line item in the budget, but that’s about what we spend

$5K car payments

$4k gas

$24K bills- utilities, credit lines, phones/internets, etc

$12K - miscellaneous

$10K- cash savings

$3K auto and life insurance

The rest I just assume my wife and kids light on fire because I’ve got no idea where it goes. Amazon mostly.

Is that $220k together or each? Trying to make sense of the math here.

That’s together. I ballparked the numbers but it’s pretty close I think.

Devil is in the detail. Almost every line item is more than it should be

Yep, like clothing, no way they aren’t buying designer stuff.

Why would you give money to your alumni when you are still paying interest on your bill and have 10-20 years left?

Fuel implies they are driving a ton.

fake news hit piece on Trump and how famillies making $500k yr are just getting by, sad!

In reality though, they might not be saving much more than what the table states. The main difference is housing cost. Let’s say you are in SF Bay Area, two engineer household or something, making $500k from both people. More than likely, you’re going to buy a house costing above $1.5 million. So, that one assumption is actually pretty conservative.

I take home after taxes around $3,200.00 a month. If these dip sht’s can’t make it work then maybe they should have realized youtube can teach their child the piano just as well as Julliard can a long time ago.

Yeah, this has got to be fake.

Kids classes are expensive, about 50 a pop / hr

I feel like I may never buy another residence. I bought my home in 2009 and recently the wife has been looking at other houses. Upgrading a house when you don’t really need to can seriously delay or affect the quality of retirement.

Unless you buy on Central Park, live in the penthouse and rent out the rest of the units. That’s a good plan.

what specifics dont you like about home ownership?

I feel like I may never buy another residence. I bought my home in 2009 and recently the wife has been looking at other houses. Upgrading a house when you don’t really need to can seriously delay or affect the quality of retirement.

Unless you buy on Central Park, live in the penthouse and rent out the rest of the units. That’s a good plan.

i deeply regret not buying multifamily and renting out other units

there is only 1 issue with home ownership and thats the price relative to the rent. any property right now, youd be lucky to have a cash on cash flow yield on your down payment and closing costs.

much cheaper to rent a place than pay interest for an overpriced home.

only way to make money in real estate right now is the off chance that inflation spikes over 3%, in which case, you’ll get a standard 10% return, when you sell the place. (and this is assuming you’re getting the top 10% deals in real estate out there)