So, it’s a myth right? We agree on that?

I’m all for it.

right. But, can you please shelve your sexual love for trump on this for 20 seconds and think about this objectively?

It has worked as a temporary stimulus to the economy. It has never worked as a catalyst of lasting, long-term growth. One of the main reasons for this is that the immediate beneficiaries of tax cuts tend to be shareholders, who have a lower marginal propensity to spend and are generally wealthy as a class (they already have a bunch of toys; they are not necessarily going to run out and buy more stuff at the margin because of a tax cut — they’ll bank it instead). The cuts never permanently bolster the degree of consumer spending, though there might be a short-term boost due to the wealth effect. Some would argue that the increase in investment this causes leads to higher growth in the long-term, but since 1987, when the system has had an excess of liquidity and investable assets sloshing around in it anyhow thanks to the Great Moderation, I’m not so sure that correlation is as airtight as it once might have been.

it all depends on the actual data right.

if the rich is spending their money then trickle down is working.

if they arent, then it is not. so tax them.

theoretically, the rich will only spend money when the people at the bottom prove their value. but what is the bottom has no value? then you’ll have to shift from trickle down to trickle up. where the rich porovdie value to the poor.

I don’t believe it’s a myth. I do believe that it is not bounded by country borders, which poses difficulty since its typically viewed through a domestic only perspective

It’s Keynesian stimulus it usually boosts the economy since you’re essentially dumping cash on people. The question is whether it’s worth the debt and whether it’s better than targeted spending by the govt (roads, bridges, military, etc.).

you give tax cuts to the rich. they will invest that money on things that they believe will make them more money which adds value. (assuming ppl invest to make money) and will therefore fuel growth as dow said.

you tax the rich and give money to the poor. then the poor will spend the money on things that they need. (like food shelter and transportation) or if you give too much then they spend it on what they want. which i imagine is hookers and big cars or busses.

Very good point.

You have to define this by region and time horizon. It definitely has worked for much of America’s history although works less now. Part of it is technology, economic shifts, part of it is that a lot of the trickling down has gone from the US to China as raw raw pointed out and ultimately, the current structure of capitalism is probably due for some tweaks because I do agree it is developing major failings. Anyhow, you can’t just look at this specifically within one region or narrow time horizon without specifying that and any economic policy needs to be evaluated within the economic system it is being applied in.

yep if the rich people are stupid. like ppl who inherited it. an waste it on bottle service. then not taxing them is pretty stupid policy. you should always tax stupidity.

Arguing an economic expansion is exceptionally easy to do on the heels of lowering taxes. But saying it doesn’t promote inequality is a little more difficult. Which in my opinion is the entirety of what trickle down economics is about. It has nothing to do with an expanding economy. Sure, it’s clear that lowering taxes, and rising GDP levels are positively correlated, but that is besides the point. We’re talking about wealth “trickling” down to poorer households. Which is not an observation with lower tax cuts.

there are actually counterarguments to that. specifically ppl dun really care about inequality as long as they are getting a lot more than what they need and dimsum.

there are actually othere concerns with tax cuts for the us though.

specifically if we keep increasing the deficit and debt burden, the concern is that rates will rise and the money govt is borrowing will crowd out money that should go to the private sector. aka “the crowding out effect”.

and the current pop thinking is that private sector is a better allocator than the public sector.

anyways so nice that rates never rose and everything theoretical i learned in econ was a big waste of time!

nowadays the popular though is that governments worldwide specifically the us (since we are the world’s currency reserve) will continue maintaining low rates by issuing more currency and buying back their own debt.

fed independence is just a marketing ploy to convince other countries to use us currency/bonds as a monetary reserve.

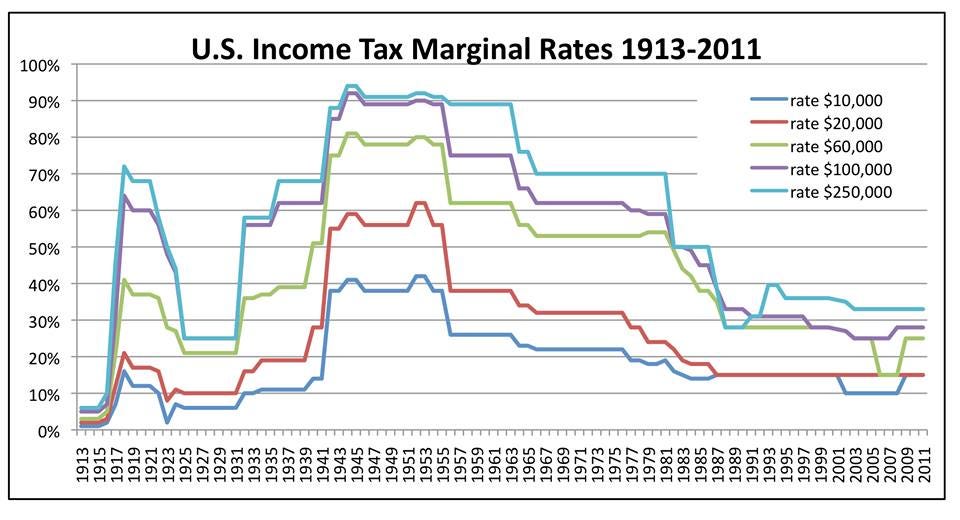

I’d like to change my vote and side with CEO. I was conflating trickle down economics (TDE so I don’t have to type it again) with capitalism. You don’t need a PhD to look at these charts and notice some things.

I didn’t have time to try to pull the data sets today so I just set the marginal tax rate chart as transparent and aligned the X-axis.

I was arguing this with someone yesterday, and in a drunken stupor I resorted to asking the experts via the water cooler.

yesterday i was teaching this dude how to pick up women (including my fiance’s sister). i was conflicted. whether to tell him to take the numbers approach and hit on girls concurrently. or to just focus on 1 girl at a time.

hes not good with women and is a virgin. but hes 25 and a tall fit white dude. i am surprised, he should have no problems in the women department. lastly what are your thoughts on older virgins? ticking time bombs, or just people who lack balls.

anyways y am i taking the time to help this dude. his dad is a cfa man. and hes a friend of one of my rich friends. so i figure fuck it. i’ll pass down some knowledge. could be a rich dude. rich ppl only have rich friends right.

Maybe he is very religious or is secretly gay. You should test this theory by giving him a shoulder rub on the pretense of reducing stress and see how he responds, then take it from there.

As for the original question, the answer for this, and most economics questions, is sure it works - just for some people and not for others.

^hahah ohai. that was actually what i thought as well. religious or gay. but he likes bishes. he literally took notes over the phone. i confirmed both. he just doesnt holler. a chick literally had to rub shoulders against each other to get him to hit on her. and all he could think of was me saying, just shove your phone in her face. lol anyways he got the digits of the girl. he called me cuz he was celebrating over that tiny success. i told him that as a man he needs to make the first move. it is very imp.

he actually said a pretty gay thing though. something about just wanting to have someone as a companion, someone to talk to. lol. anyways its eitehr gay or virginy.