Sorry, I misunderstood.

Except i’ve made 50k in capital gain on a house i’ve bought in May. If i was wasting my time i’d be writing nonsense on a forum…like you.

-

So you have that cash in your account? No? Then what you have is a paper gain. Sounds familiar.

-

So you’re not posting on forums?!

But even if the first two points held up, you’re still picking up pennies in front of a steam roller of risk. After the crisis I worked in business banking for a bit and saw 100’s of people just like you. Six properties underwater, revolvers drawn out, all vehicles 2007 models. All on a path towards losing their homes, ability to have credit, lifestyles and in some cases livelihood and families.

Well, if your plan is to keep the houses for 20 years or whatever, you will probably still make money regardless of any downturn in the short term. This assumes, of course, that you will not go bankrupt from leverage in a price decline. What really kills you in real estate, though, is the transaction costs. It might not ever make sense for you to sell buildings because of the 10% or whatever cost of selling. Instead, real estate might be better viewed for their rental income potential than for capital gains.

I’m pretty sure the market knows what it costs to sell real estate so it’s priced in on the buy.

…also something like 75% of market real estate returns historically are due to capital appreciation.

Do people enjoy living in London? I never hear anything good about the weather, food or costs.

Well, not necessarily, since “best usage” of the property might assume no selling. If a real estate company owns an apartment building, such as the one I live in, then perhaps the market reflects that the building’s operation is a going concern.

The other obvious point is that a higher frequency of selling increases transaction costs. So, it might not make sense to buy a house for say, a 10 year horizon, after which you intend to take gains and repurpose the money. The market might assume that it’s best to hold your house for as long as possible, until you die.

Even if you ignore all this, selling is effectively the choice between a house that someone would pay $1 million for and $900k in cash. Assuming the market is otherwise efficient, it is obvious that one should choose the house. Life issues that would force you to sell the house would not be reflected in the value to other investors.

maybe we’re mixing real estate consumption with investment, which happens all the time. My point was that from an investment perspective, transaction costs are known and are therefore accounted for in the price. There are tons of strategies the employ high turnover and transaction costs are no a deterrent. I’ve done deals with institutional money with an eight month hold period. Most value add or development strategies assume a 3 year hold. At most transaction costs account for about 50 bps of IRR. Everyone knows this and money continues to pour into these strategies. No one is deterred by transaction costs.

-

Institutional and private transaction costs differ greatly

-

I don’t think you can count a 3 year development strategy in the same family as private residential investment by an individual.

Most individuals investing on real estate require long holding periods and high leverage to make any real money. These two things lead to major paper gain accumulations and contribute to the large collapses after extended buildups that we’ve seen.

true to some extent. i agree it’s very crowded in the residential space where wanna be landlords have basically turned say under 8 unit residential real estate into a retirment savings plan – cash flow barely covers debt and expenses and your only gain is that you can pay down your mortgage principal our of cash flow. That’s not a place for high turnover unless you’re in a dynamic boom/bust market. But there are plenty of other investible alternatives under the institutional radar in the $1 - 5 million range. Savy investors can do very well in this segment. I personally know several who started here and now have 9 figure portfolios.

Do people enjoy living in London? I never hear anything good about the weather, food or costs.

Weather in London is better than you think. It rarely gets very cold in the winter. Much milder than say central and north east US. Summer is generally warm without getting very hot. If you want sun, you’re a two hour flight from a huge range of great destinations in Spain, France, Italy etc.

London is like any major city now for food. You can find restaurants representing pretty much any cuisine in the world from very cheap to very expensive. Quality and range is comparable to New York, Paris, Tokyo.

Cost of living is very high. Also comparable to above cities.

So, we’ve seen a different house and intend to sell our current one (which we bought in May) and purchase the new one. We’ve had the current one valued and the paper gain is £50k… I really depends on how much it sells for but i’m confident it will go for something closae to this.

We are sticking most of our monies into a new home, which will be our residence and keep another BtL in an up and coming area. Given how much spending we’re doing it’s unlikley i’ll be able to grow the housing portfolio beyond…well 2 houses…

The difference in the last US real estate crisis between people who made money and people who didn’t was some people kept plowing everything back into real estate and some kept some profits. I hope all goes well for you, but what you are describing is scary.

Pokhim, one other thing to keep in mind as you determine how to position yourself financially:

Capital Economics just put out a peice highlighting data that’s been coming out of emerging markets showing significant slowdowns in consumer spending in Brazil, Russia and now countries like Saudi Arabia that had previously been holding up. Given that the oil slump is expected to be more of a five year problem with limited price upside, you’re likely to see significant further erosion of the financial position across those countries. The Saudi government is already starting to stare down a budgetary fiscal timeline where it appears they may be the ones forced to blink first in the production war with the US, which is a bit of a shock to a lot of people. If the international buyer is a major source of price support in London (which is the generally accepted thesis) and this is a multi-year problem, it would really elevate your risk over the near to mid term.

Just be aware of that, I’m actually trying to be helpful here.

Pokhim, one other thing to keep in mind as you determine how to position yourself financially:

Capital Economics just put out a peice highlighting data that’s been coming out of emerging markets showing significant slowdowns in consumer spending in Brazil, Russia and now countries like Saudi Arabia that had previously been holding up. Given that the oil slump is expected to be more of a five year problem with limited price upside, you’re likely to see significant further erosion of the financial position across those countries. The Saudi government is already starting to stare down a budgetary fiscal timeline where it appears they may be the ones forced to blink first in the production war with the US, which is a bit of a shock to a lot of people. If the international buyer is a major source of price support in London (which is the generally accepted thesis) and this is a multi-year problem, it would really elevate your risk over the near to mid term.

Just be aware of that, I’m actually trying to be helpful here.

Thanks BS, I appreciate your opinion and I think it’s certainly valid. I don’t really have a mid-term time horizon; maybe 15 yrs is my time horizon as i have cashflows to see me through difficult times.

My only concern is upcoming changes in tax law which could mean BtL investors are forced to sell as post tax yields fall. This will lead to an oversupply and fall in house prices. However, i think this will be a temporary blip in London and i’ll ride the wave.

I’m getting my house valued and put on sale this weekend. I’ll let you know how it goes.

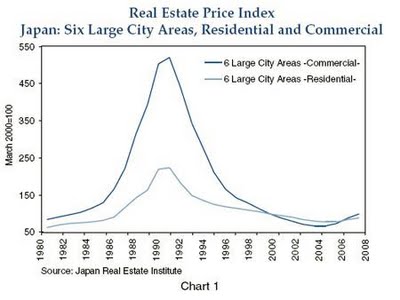

I once read that at the height of the Japanese bubble the value of Tokyo was worth more that the entire value of all real estate in the US. Not sure if that true, but there’s no doubt that there was a tremendous bubble in Tokyo (a worldwide top 5 city) in the 90s and the drop following the recession was profound.

Wait this is kind of scary. Because even today, no one can afford to live in Tokyo. What did people do in the 1990s?

Camped in the shadow of Mt. Fuji.

I once read that at the height of the Japanese bubble the value of Tokyo was worth more that the entire value of all real estate in the US. Not sure if that true, but there’s no doubt that there was a tremendous bubble in Tokyo (a worldwide top 5 city) in the 90s and the drop following the recession was profound.

wouldn’t surprise me. Japanese RE prices are down about 80% from peak last time i checked, so back then they were 5x their current value and U.S. prices were depressed relative to today’s values, mostly due to interest rates.