AF Go

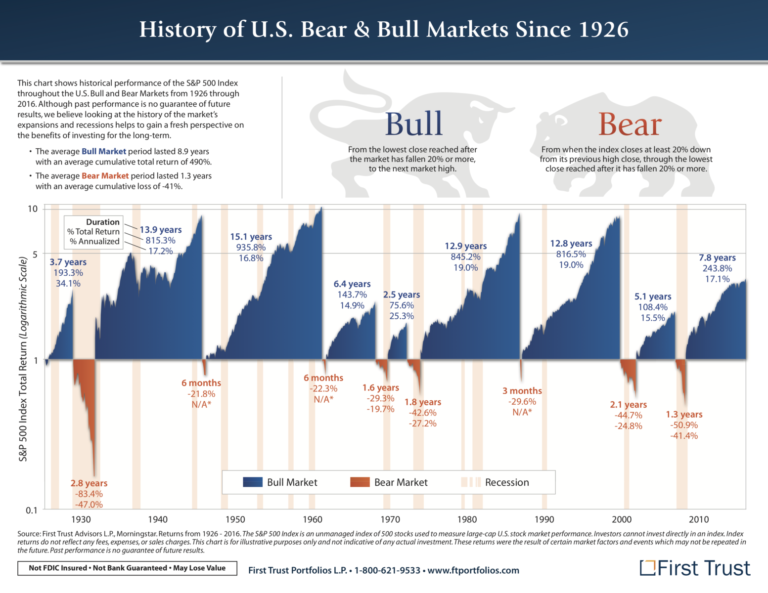

20% drawdown happens about one in every three years on average. 10% happens once per annum on average. Approximate figures of course.

some very accurate and robust probability analysis right there…

Trump impeachment would do it. Judging by these proposed bills and investigations it could be as early as 2017 EOY.

carson is correct, a lil off by a bit but in the general vicinity. we are more than 8 years since the crash of 2009. extended multiples, ridiculous earnings estimates. i wouldnt be surprised of a 2017 crash, but i vote 2018. carson i never done the analysis, but what are the odds of a 30% downside? have you tried that?

Why don’t you ask Gartman.

uhh most finance executives and media including Barron’s, WSJ believe trump impeachment would catapult the market and the economy. Don’t argue with me on why or say that these are fake news blah blah. I am just relaying a message said by people much smarter than us or in a lot more bigger positions who most likely don’t spend their time on an anonymous AF forum lol.

I’d tend to agree. You remove the distractions (unless Pence is also crazy, which is possible) and still maintain a Republican control. To me, that increases the probability of the pro market stuff happening. But it would depend on if it’s viewed as a Trump problem or a Republican problem, because then it could jeopardize the control in 2018.

Fake news, they said the market would crater if Trump got elected president. Wrong!

maybe trump is not even the president after all. How do we know that Trump is actually the president. The media is faking all this. FAKE! lmao.

Please cite sources, Google’s not showing me any of this consensus you’re referring to with most of what I have found saying the opposite. Not to mention, most of those magazines also will post articles taking either stance at intervals rather than having one unified view. In addition, relying on public outlets to form your markets outlook is so hacksaw. Remember when the all knowing f*ckups at Barrons ran the “Facebook is Worth $15” cover story? Guess they misplaced the decimal. Those speculation pieces about the future of markets aren’t worth their weight in toilet paper.

http://www.barrons.com/articles/SB50001424053111904706204578002652028814658

It also seems odd to me that the pop-economics rags that claim we had a 15% “Trump rally” post election are expecting a 15% rally on his impeachment.

Personally, I think the “Trump rally” was driven by contemporaneous factors with the result erroneously pinned on the election outcome, so I’ll give you that. But I also think (and I’ve made this point repeatedly) that the office of president has no correlation to either economic activity or the performance of markets except in cases of extreme economic reform like Argentina or Venezuela to the downside. I ran hundreds of regressions on this in grad school resulting in no meaningful correlation between the office of the president and economic / market activity. The concept that the two are more than tangentially related is one of the biggest myths in modern financial news rags. It’s there to fill print and sell copies like talking heads attributing random market shifts to BS indicators.

Anyhoozle, with respect to the original question, I’ll guess 2020 / 2021 for a 20% decline.

carson, infi, klaud, and hpr. do you guys have any guesses for what year? minimum 20% decline. rofl i got this idea btw from some guy who mentioned that we need to check the af boards for market consensus. haha

Market timing like that is very difficult if not impossible.

I got those figures of one 10% drop in the S&P500 each year on average and one 20% drop every three years from a Goldman Sachs presentation on this topic. Their main conclusion is that in the long-run, you lose more by nervously selling your holdings too early in a bull cycle (and by corollary being too slow to buy in after a crash) than you do by staying long the whole time.

Now they have a natural bias to have investors constantly active in the market. They aren’t going to advise you to sit on cash for a couple of years. But with that caveat said, the analysis was pretty convincing.

Another side point to note - what do you mean by a 20% drop? Is it a 20% drop from the previous cycle peak, from the Dec 31st value of the preceding year or from the highest point in the current year? The last one especially is not very meaningful. If the S&P 500 fell by 10% over the next month, it would be only barely below where we started the year. And no-one was screaming that the market was cheap in January. Even a 20% correction only gets you back to late 2014 levels and the market might only stay at those prices for a short time so you could miss the bounce.

Last point, the VIX is very low at the moment. Buying a put on the market might be a better way to be cautious now rather than selling out of your positions.

within an order of magnitude 3~9

peak to trough on market cycle or spanning from a few months to multiple years is my definition. they prolly analyzed it in this manner. just unsure what there starting point was. anyways yes market timing is the wrong way to go about it. but the idea to hold cash over say bonds nowadays isnt too crazy. if rates rise, bonds will suffer depending on duration. and you are purchasing the bond for a 2% yield for say a 10 year. so cash over bonds aint so crazy. i read it from some really renowned manager. cant remember who but that was his main point.

personally i dont think i would buy puts. but you’re definitely right about the vix. i’ve read a lot of articles on it.

i havent done much work on options. but i just checked the premium prices for a june 2018 put for a 240 strike price is at 18 bucks so ~8% premium. market has to fall greater than 8% for you to win.

In comparison holding cash is prolly an opp cost on potential gains for average market. so prolly a 10% average. but flat markets its whatever, and slightly down markets its whatever.

Waiting impatiently, this is the most boring market ever.

nice chart, brah

collecting 20% yield from 2x lev ETNs for now

i think they are using monthly data.