In reading 16, there is the section about “Business cycle and asset returns”. This is perfect to put in a small text and ask to justify which part of the cycle you are in. Any hints to remember all these points?

Just go back to the basics. You got your recovery, your early upswing, late upswing, downturn, etc… Now you just have to understand the vignette as they describe it. Usually they will talk about equity prices, inventory, inflation or interest rates.

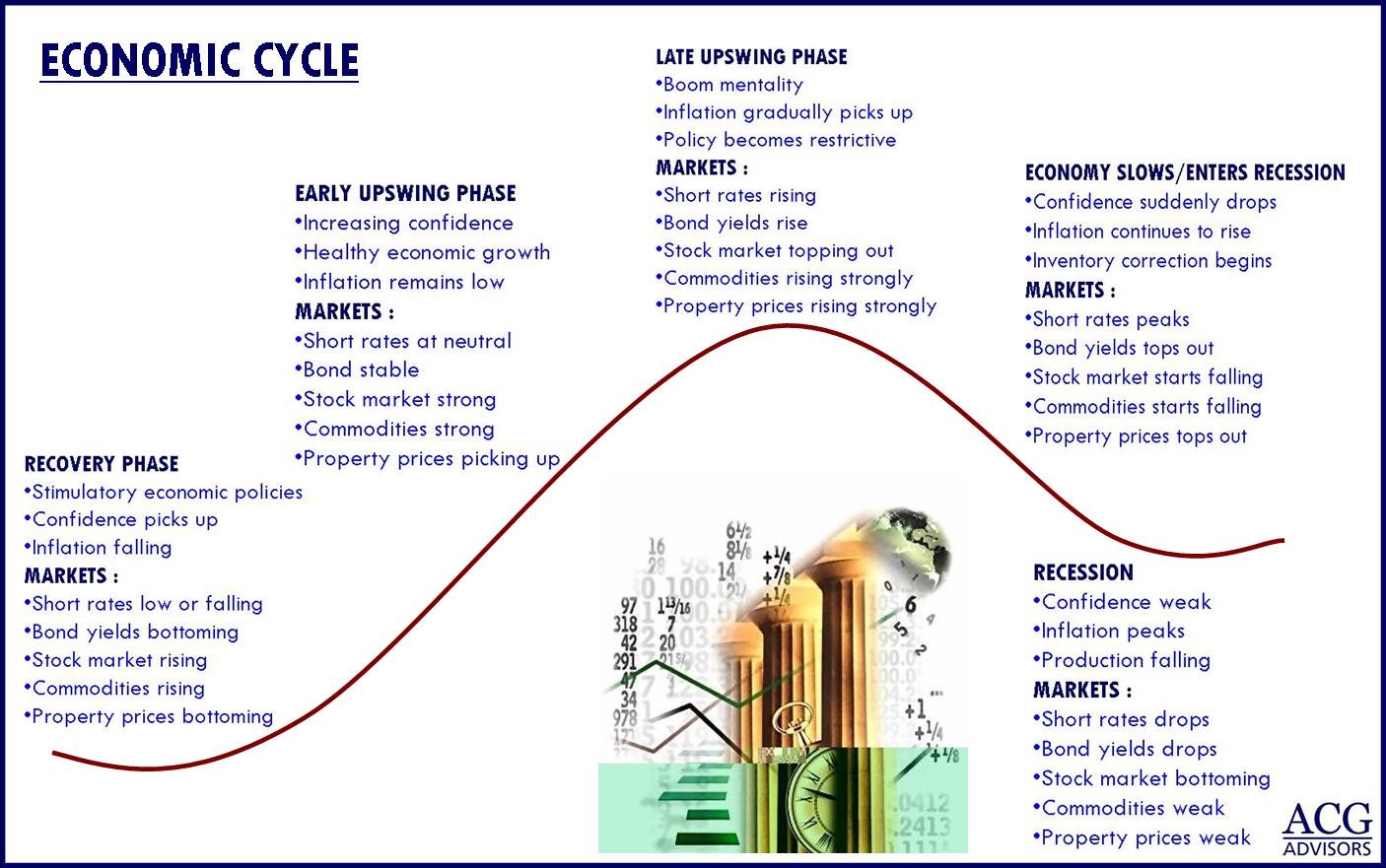

I found this somewhere that might be helpful.

It is very difficult to memorize and all characteristics of a a part of business cycle. I would say it is enough if you understand which variable moves with and against the direction of the business cycle

Thanks. I have zero background in economics. I understand the following:

Cycle Stage** Initial Recovery Early Upswing Late Upswing Slowdown Recession****Inflation (Lags)** Falling Increasing Accelerating Leveling off Decreasing Confidence Picking Up Increasing Booming Waning Plummeting Equity Prices Low or falling strong market topping out starts falling bottoming Inventory (leading) Depletion Catch up Overshoot Accumulation Correction

The last time I took real economics class was age 19… That was 21 years ago