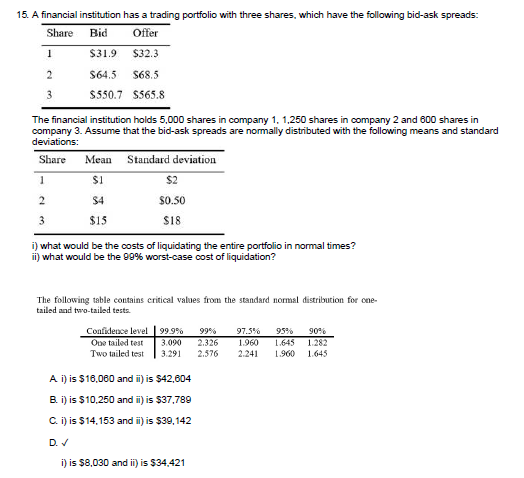

Hello everyone,

Could anyone explain how to solve this case?

For question i I come up with

(32,3+31,9)/25000=160.500

68,5+64,5)/21250=83.125

(565,8+550,7)/2*600=334.950

0,4/32,1 = 0,012

4/66=0,061

15,1/558,25=0,007

This times the capital gives

1.000

2.518,94

1.132,5

=4.651,4

Somehow I do not get to the right answer.

The second part is even harder.

If someone could help me I would be very grateful

Kind regards

Luc

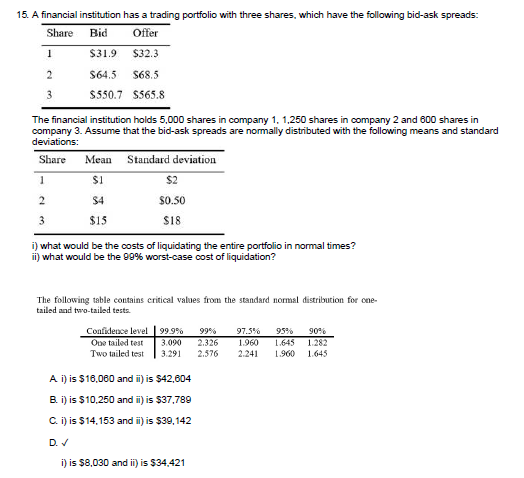

i) Cost of liquidating the entire portfolio in normal times

Mid-price

Share 1: (31.9+32.3)/2 = 32.1

Share 2: (64.5+68.5)/2 = 66.5

Share 3: (550.7+565.8)/2 = 558.25

Bid-offer Spread

Share 1: (32.3-31.9) = 0.4

Share 2: (68.5-64.5) = 4.0

Share 3: (565.8-550.7) = 15.1

Mid-Market value

Share 1: \$32.1 \times 5,000 = \$160,500

Share 2: \$66.5 \times 1,250 = \$83,125

Share 3: \$558.25 \times 600 =\$334,950

Proportional Bid-Offer Spread

Share 1: 0.4/32.1 = 0.012461

Share 2: 4.0/66.5 = 0.060150

Share 3: 15.1/558.25 = 0.027049

Cost of liquidation in normal times

= \$160,500 \times 0.012461/2 + \$83,125 \times 0.060150/2 + \$334,950 \times 0.027049/2

= \$8,030

Or

= 5,000 \times \$0.4/2 + 1,250 \times \$4.0/2 + 600 \times \$15.1/2

1 Like

ii) 99% worst-case cost of liquidation

= 5,000 \times (\$1 + 2.326 \times \$2)/2 + 1,250 \times (\$4 + 2.326 \times \$0.50)/2 + 600 \times (\$15 + 2.326 \times \$18)/2

= \$34,417

1 Like