Any cute ways to remember max profit/ loss for cov calls/ prot puts or just sheer memorization?

thanks

Any cute ways to remember max profit/ loss for cov calls/ prot puts or just sheer memorization?

thanks

Hmm, depends on what part you’re struggling with and I can try to recommend an easy way to memorize. Is it remembering how the form of each contract is set up (like the combination with sold call or bought put), or is it understanding who gets or who pays premiums on each side?

I was fortunate enough to learn a lot of this in school and now its just second nature to draw out the contracts, so if this helps you then go for it:

i find the questions related to this pretty simple and plug n play type.

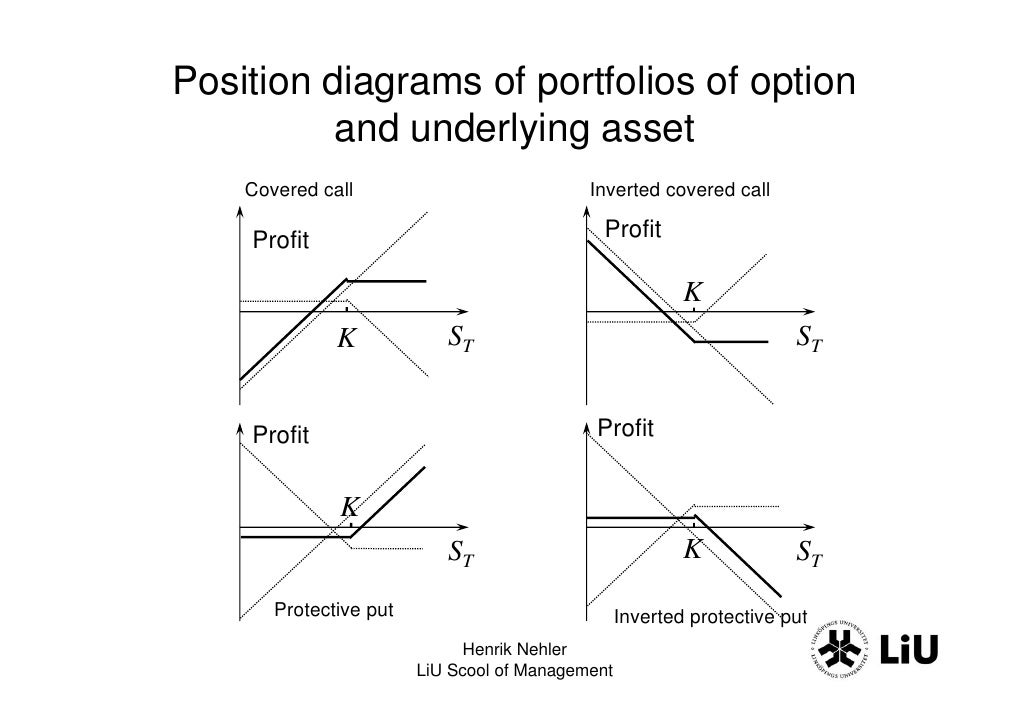

regular long/ short call/ puts max profit/loss are easy. the diagrams help there. but cov call prot puts is burdening me!!

For these type of problems, it is better to solve it with a table.

For example, protective put. Strike price is $60, premium is $4, current stock price is $65. At expiration, stock is trading at $61.

This is how I solve it.

S LS LP Pre Net

$61 -4 0 -4 0

if the question asks for max loss, just make S=0

0 -65 60 -4 -9

if the question asks for max gain, make S as high as you want.

100 35 0 -4 31

so in this case, max loss always -9, and max gain always 31.

for protective put, break even point is So - premium

for covered call, break even is So + premium

If anyone has better way to solve this, feel free to share !

Huh, just draw the picture and it should be pretty easy.

What is LS and LP?What do they stand for?

Long stock and long put