Hi everyone

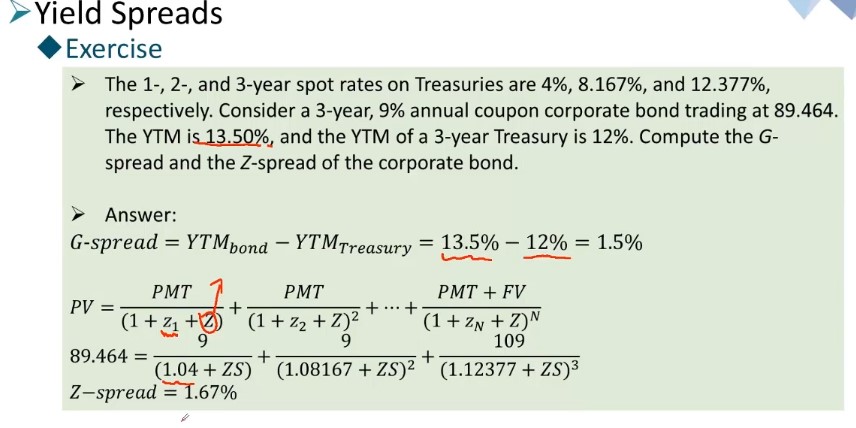

Would anybody help me with this calculation of Z spread in below picture.

How to use BA II Plus calculator to calculate the Z spread?

Thanks very much.

Using Excel is easier otherwise you have to do algebra by hand. For the calculator part, i’m not sure that it has this function or not. Probably you have to ask the expert @breadmaker on the calculator.

Thank you for your reply.

What if i got one of this type of question in the exam, I won’t be able to use excel.

I will ask breadmaker and hopefully it will be solved.

Thank you again.

In general, you cannot calculate a z-spread algebraically.

If they ask you calculate a z-spread on the exam, you should look at the answer choices and try the middle one. If it gives you the correct price, then it’s the correct answer. If not, you’ll see whether it’s too high or too low and choose the correct answer accordingly.

@S2000magician Thank you.

But, my question is whether it is possible to calculate the Z spread in this question by using a calculator?

I know how to calculate an IRR, but this is a different case, therefore I have no idea how to calculate

There is definitely not a preprogrammed function to handle solving for a z-spread. I can’t think of a way to to shoehorn the data through existing functionality either.

The answer is: technically, yes. You will have a cubic (3rd-degree) equation in the z-spread which you can solve using Ferrari’s formulae (though they were originally discovered by del Ferro and Tartaglia, and published by Cardano). However, as a practical matter, nobody ever solves for a z-spread algebraically; it’s done numerically using something like Excel’s Goal Seek or Solver.

@S2000magician

@breadmaker

Thank you both

I will take your advice. This question is only demostrate how where does Z spread come into place in a situation like this, I haven’t come across a practice or past exam question in CFA Level 1 like this yet.

Thank you everyone for your response.

Let’s say your answer choices are A. 1.2% B. 1.5% C. 1.69%

Using the patented S2000magician method, I will try out 1.5% first and plug and chug with the TVM worksheet:

P/Y=C/Y=1

END

2nd CLR TVM

1 N 5.5 I 9 FV CPT PV -8.530805 STO 1

2 N 9.667 I 9 FV CPT PV -7.483255 STO 2

3 N 13.887 I 109 FV CPT PV -73.791109 STO 3

RCL 1 + RCL 2 + RCL 3 -89.812414

My answer is above the stated price of 89.464, so I need a higher discount rate, which means a higher z-spread. Therefore, the answer must be C.

And that is why you are the expert.

@breadmaker

Wooow

Impressive.

Thank you very much breadmaker.

What do you think of Monday’s Boeing Share price?

Or will S&P go below 2150?

I’m an actuary, not an investment guy.

Anyway, thank you for your effort

Have a lovely day.